Chargebacks, Stripe and fighting broken online payments

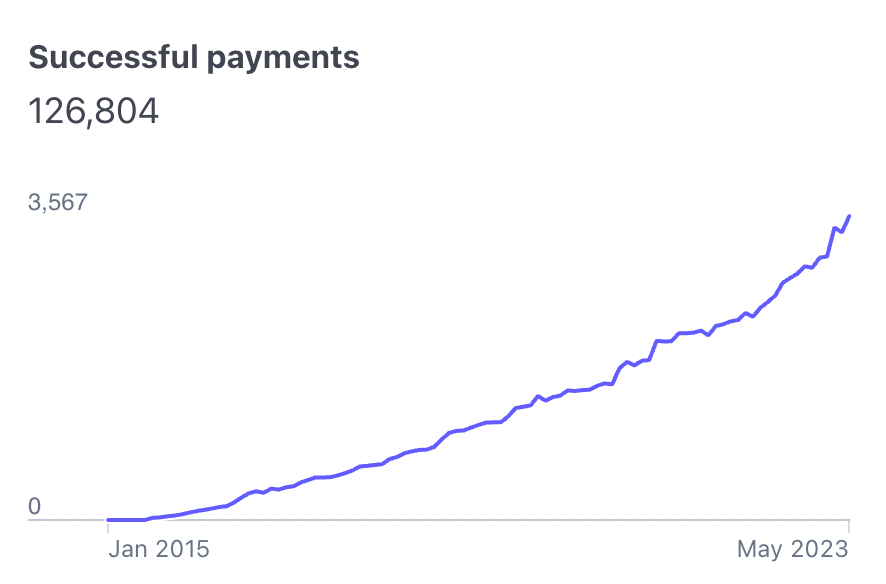

Alongside Jonathan, I run EmailOctopus. A bootstrapped, 10-person, SaaS email marketing platform. While we're small in headcount, we've managed to process 126,804 payments since our first Stripe payment in August 2015.

Very early on, after a fraction of those payments, we'd worked out that the online Card payment process, serviced by Visa, Mastercard and American Express, is broken.

Broken because of chargebacks.

What are chargebacks?

Chargebacks are a way to get your money back when you buy something with a card and there's a problem. Rather than speaking with the seller of the product (the merchant) to mediate a solution, you go straight to your bank or card issuer.

When a chargeback is issued, the bank then takes on the communication with the merchant. They do that by immediately placing a hold on the payment and request evidence that the payment was indeed legitimate. And if they decide that you're right and there was a mistake, they take the money back from the store or seller and give it back to you.

The issue with chargebacks, though, is they are ripe for abuse. They're abused on a daily basis, by those who want an item or a service and simply decide they don't want to pay for it.

Our experience

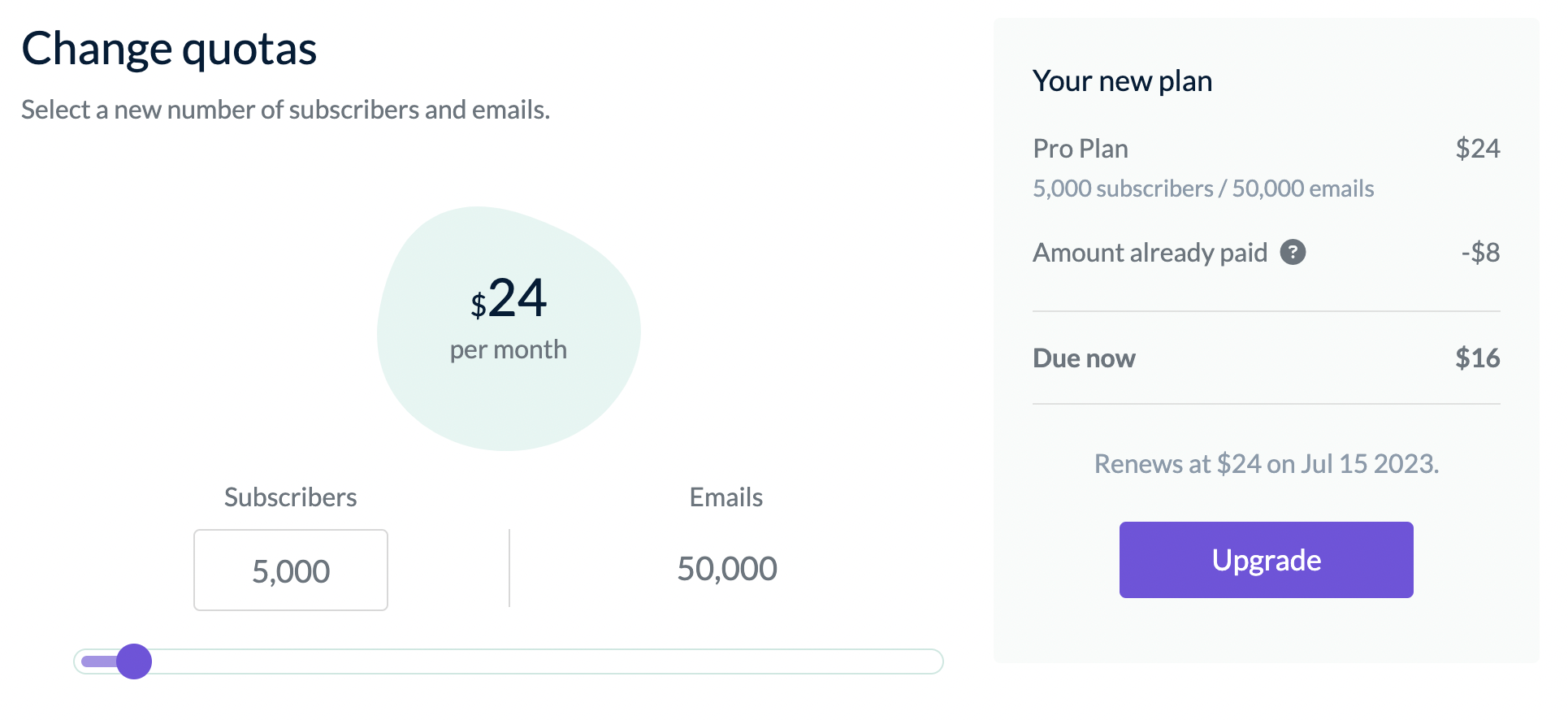

EmailOctopus is a SaaS (Software as a Service) platform. This means our customers pay on a monthly basis to access the service which provides the capability to send out emails in bulk to a client base. As a result we process hundreds of payments on a daily basis, some from new customers starting a subscription, some from those renewing (payments are recurring), others from those upgrading to send more emails.

We receive chargebacks on a semi-regular basis. The majority as a result of customers forgetting their payment was due to renew – and rather than get in touch, where we'd refund the payment – they file a chargeback. As a result of the chargeback the funds are held and we pay a $20 fee as a result. It's not unusual for a $8 payment to be disputed, and for us to pay out $28 as a result. Incredibly frustrating, but something we have come to accept as a cost of running a recurring subscription business.

We also see chargebacks, though, which are outright fraudulent. Established businesses would sign up to our service, send thousands of emails to their customer base, achieve strong metrics, yet then chargeback the transaction.

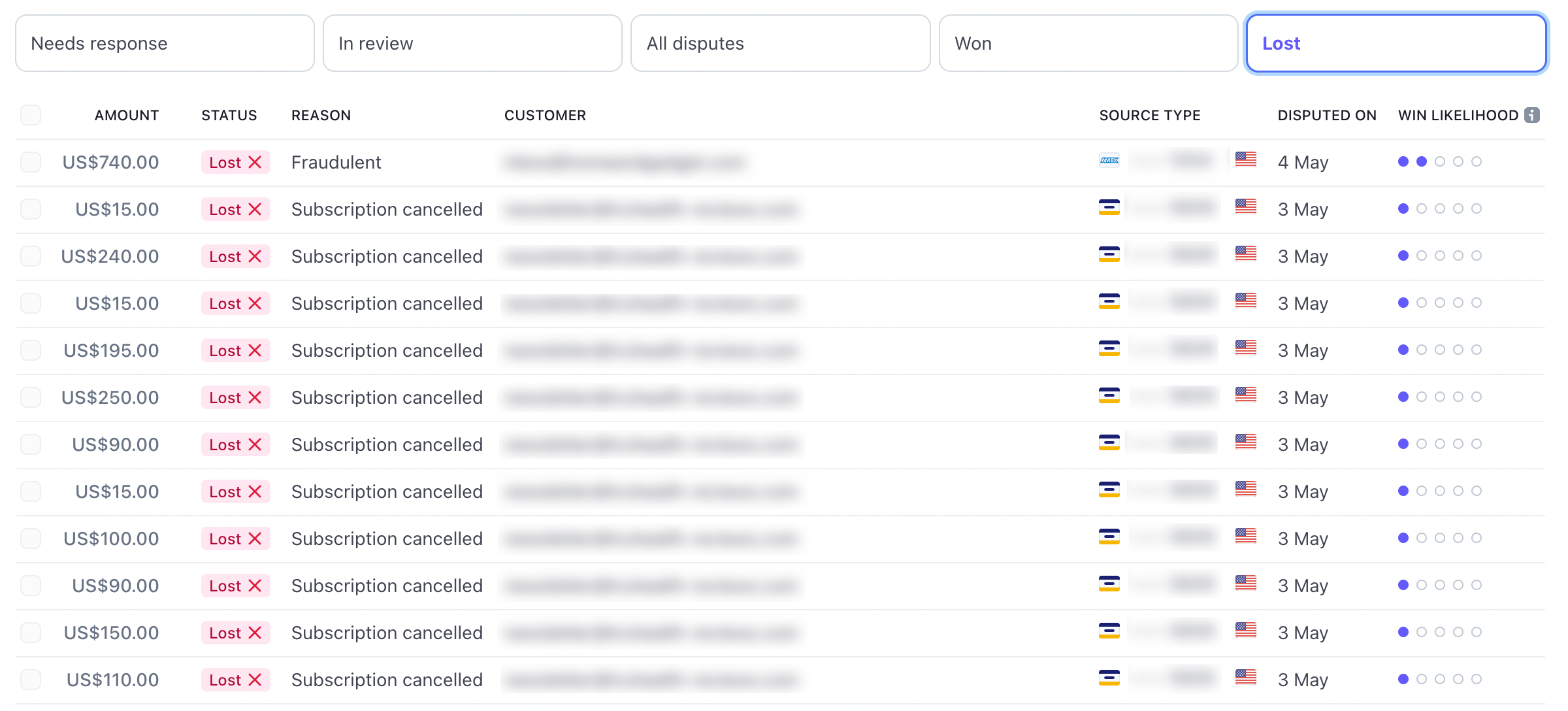

In April 2023 we received chargebacks from 2 businesses, worth in excess of $5,000 for a service which had been well-utilised by both of them.

Why you will lose Stripe chargebacks

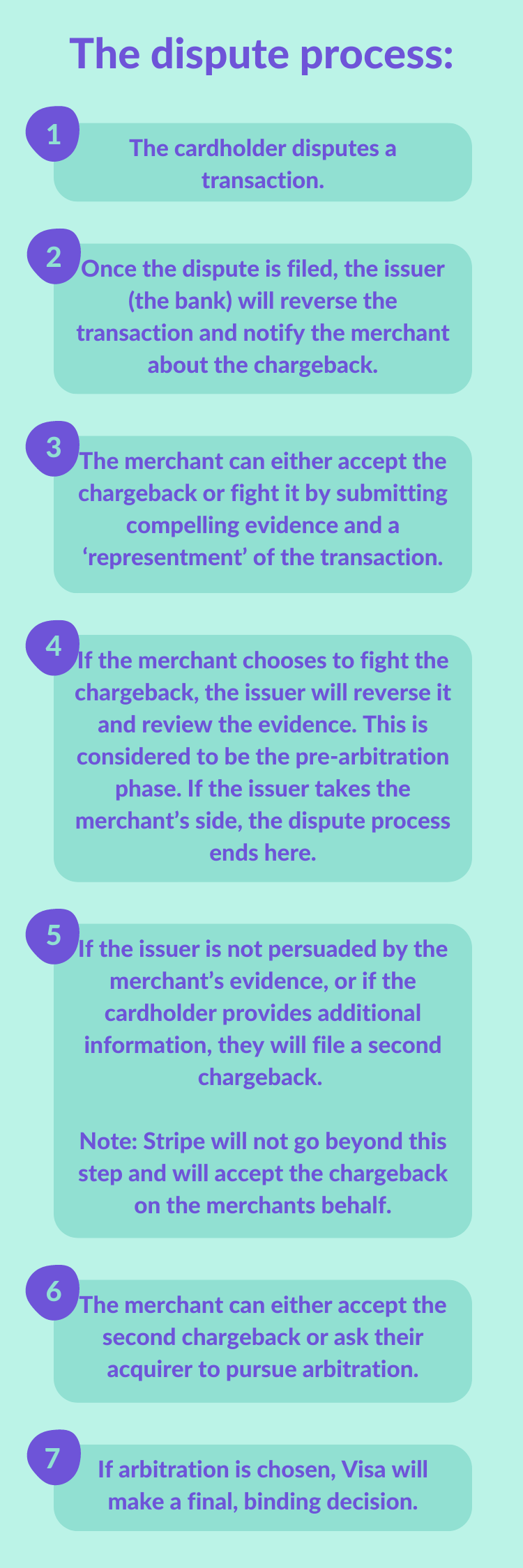

Unfortunately, however fraudulent a chargeback is, the likelihood is you will lose. When somebody files a chargeback it goes through a phase called 'pre-arbitration'. This is a process where the issuer (usually the bank) seeks the return of funds from the merchant. Which, when using Stripe, means Stripe withdrawing the funds – plus a $20 fee for good measure – straight out of your account.

During pre-arbitration you have the ability to make representations to the bank. They will provide a reason for the payment being charged back, and you will in turn provide evidence as to why that reason is invalid.

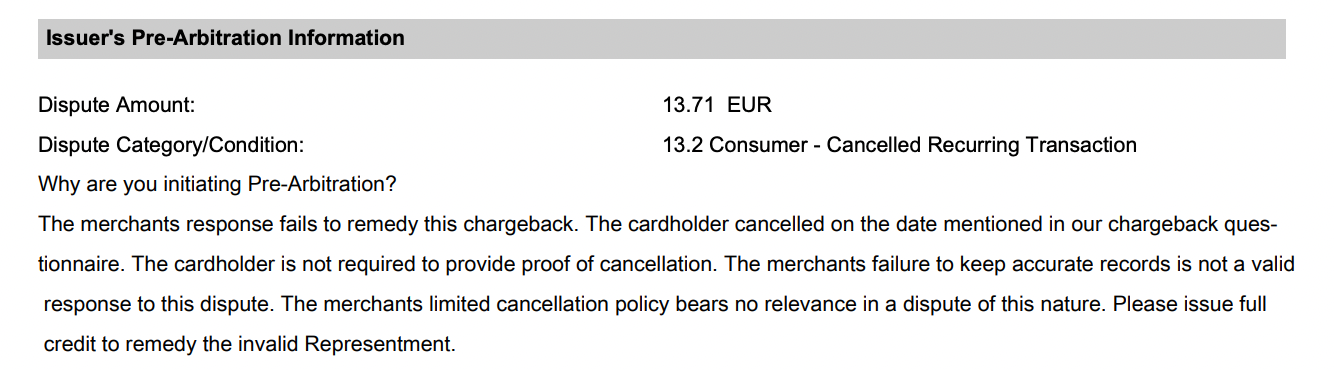

In April we received our own pre-arbitration request for the $5,000 dollars of fraudulent chargebacks. Filed by a customer, who claimed that they had cancelled the subscription. A subscription which had only started a month earlier.

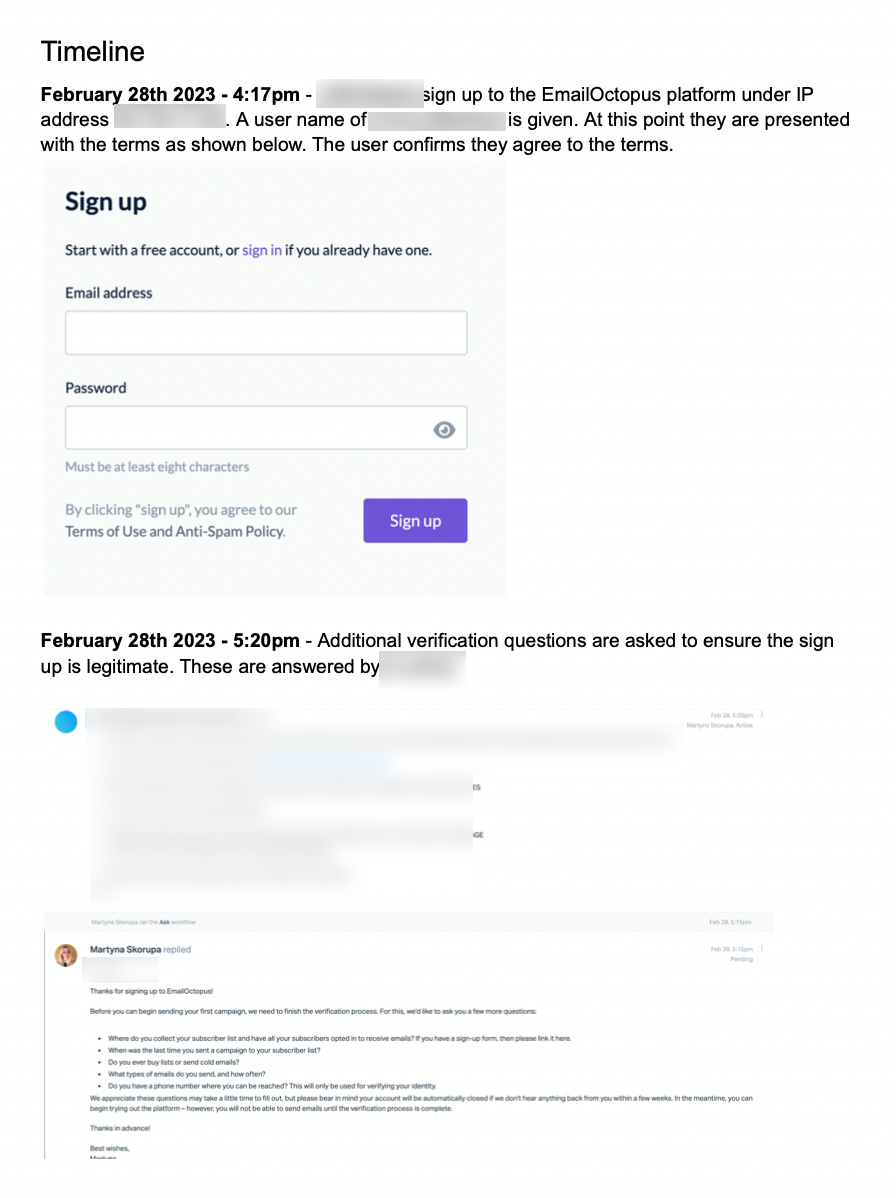

We made our representations, which were to be sent to the bank to assess how legitimate the claim was. From our side, this meant providing details of our terms of service, timestamped sign ins, customer support contact made with the customer, evidence that a cancellation was made after the chargeback and activity of the customer across our service.

The customer had been actively using EmailOctopus within their subscription and we provided 13 pages of detailed evidence to prove it.

Despite the overwhelming evidence, JP Morgan didn't think that was sufficient and ruled that the chargeback was legitimate. Their response was that providing proof that the customer cancelled at a later date and was actively using the product, was not sufficient proof that they hadn’t canceled at an earlier point of time.

With strong evidence of our own, and the customer providing inconsistent evidence, we asked Stripe why our dispute had been lost.

They replied: "These disputes being lost mean the reviewer at the issuer read the evidence packet you submitted, compared it to whatever card network spec for those disputes reason they have, and decided it either did not meet the criteria, or did not satisfy some threshold of proof internal to the issuer."

In short – the issuer, the bank, can decide (for whatever reason) to reject a chargeback in pre-arbitration.

We asked to take the chargebacks to arbitration. Arbitration is the next phase where the card company (Visa, Amex or Mastercard) assesses the claims from the issuer and the merchant, then makes a decision. With less skin in the game, we believed this would be a more independent and fair decision.

Stripe responded: "I know how important it is to proceed with arbitration, especially that we're talking about multiple disputes here, however Stripe doesn't support arbitration"

And that is the simple explanation. The issuer knows Stripe will not challenge them. There is no risk from a bank in rejecting a chargeback. So with no cost to them – and the chance to keep a retail customer happy – you're going to lose the majority of chargebacks. And there's no way to fight it.

With Stripe making a sweet $20 dispute fee and bearing no cost, there's no incentive for them to improve the process. With Stripe, the Banks and the customer all playing a no-lose hand, it's an unfair game.

How we recovered the funds

With Stripe unwilling or unable to fight our corner and with the chargeback amount in the thousands of dollars, we opted to recover our funds through a civil claim. In our instance, the chargeback cost was thousands of USD. In our earlier business days that would have been catastrophic, and while we can now cope with such a loss, it is essentially theft. If someone was to take $5,000 from my pocket in the street, I'd do what I could to prevent it – why should it be different just because it is online?

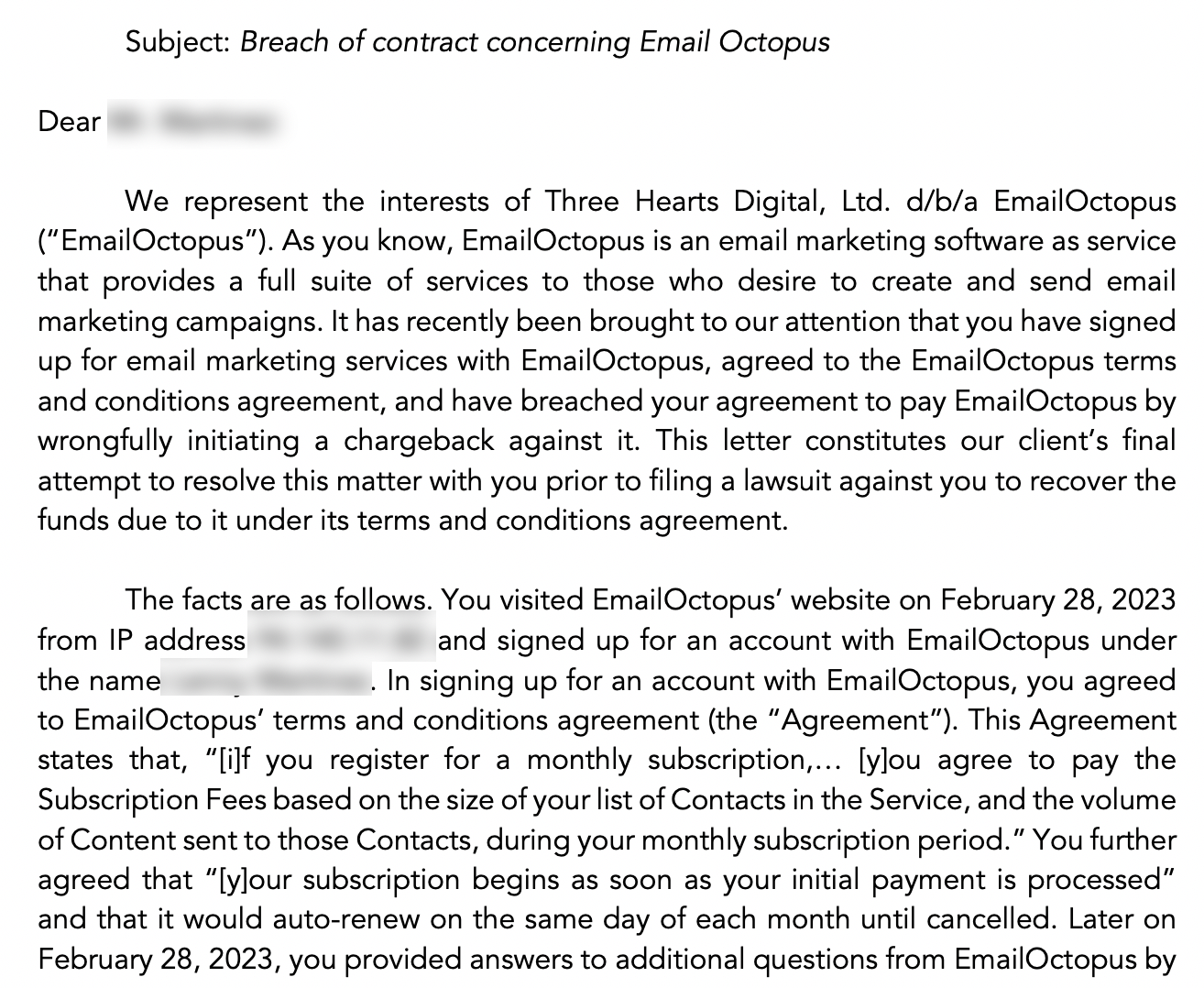

Initially we looked to resolve the claim amicably and began emailing and calling the customer; hoping that they would accept it was filed in error and withdraw it. To four emails and three phone calls, there was no response. The lack of response indicated that they were neither disappointed with the service, nor were they mistaken in doing the chargeback. So we began to consider how to take it further.

The only available next step in such a scenario is to engage a law firm to attempt to recover lost funds, either via the courts (small claims courts exist Worldwide) or through a mutual agreement. So we engaged our US-based law firm and asked them if they could help. Admittedly it wasn't something they had a huge amount of experience with, but a dispute is a dispute for most business lawyers and they took it on.

We provided the detailed empirical evidence we sent across to Stripe, and they immediately set to work drafting a letter, containing the evidence, to the client in advance of court filing in Florida.

The letter was sent by recorded post on 12 May 2023. The following day, following the delivery of the letter, the customer contacted me directly via email and asked for an invoice for the full amount he owed which was to be paid by Bank Transfer.

Within 24hrs all lost funds were back in our account and the invoice was paid. The Chargeback remains lost, along with the $20 Stripe chargeback fees. But outside of that, and the cost of the legal letter, we were back where we always should have been – having provided the service exactly as requested by the customer.

Our experience

Stripe, with their steadfast rule of never going to arbitration leaves startups in an awful position. The banks know their position is safe. Customers are charging back legitimate purchases. And merchants, many of them small, independent businesses like EmailOctopus, bear the cost.

We implore Stripe to change their processes and support businesses which use their platform by supporting additional steps and processes to fight fraudulent chargebacks.

Long term, though, chargebacks and the online payments industry has to be overhauled. The cash flow and stability of small businesses rely on it.